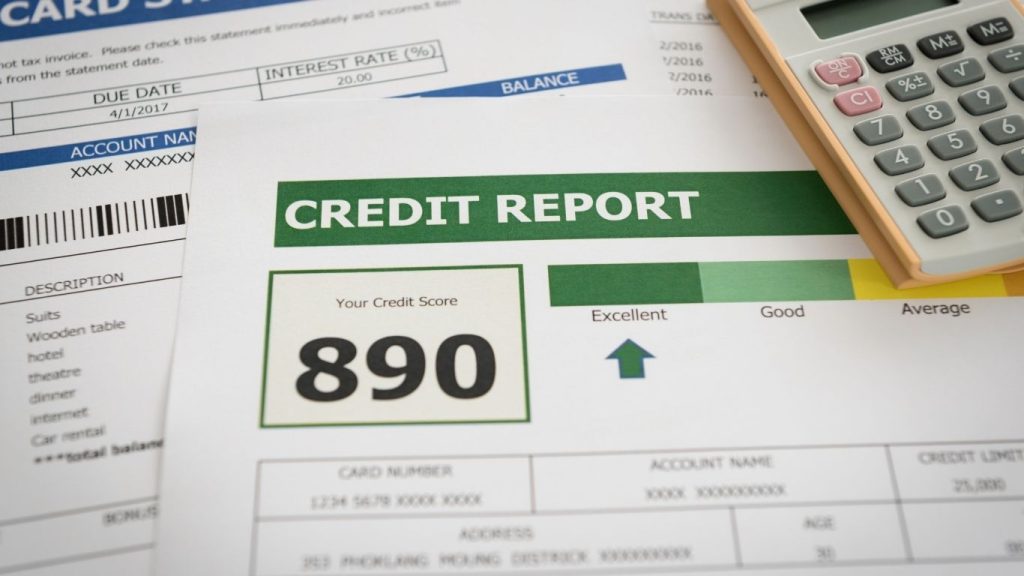

In today’s world, a credit score plays a vital role in your financial life. Whether it’s for a car, a home, or even a personal loan, your credit score can make a huge difference. It has the power to open doors for you or close them. Not just a loan approval, your credit score directly affects how much you pay over time. A higher score takes you towards better rates, lower monthly payments, and saves you thousands of dollars in interest. That’s why fixing your credit is much needed — it’s a smart financial move.

The Hidden Cost of Bad Credit

Not everybody understands or knows the effects of a bad credit score. A low score not only makes it harder to get approved, but also increases the interest rates you’re offered. This means you have to pay more for the same amount of money than someone else with a good credit score.

For example, a person with good credit might have a credit score of 14% or more. Throughout the loan, that difference can add up to thousands of dollars. The same applies to credit cards, where fixing credit can lead to better rates on mortgages and even lower insurance premiums.

Better Credit = Better Borrowing Power

But there is a way. You can improve your credit score. With it , you can earn financial freedom. Lenders look at your credit report to understand the risk of lending to you. A higher score shows that you are serious with your finances,financial and have control over it. They see you as a responsible person with money and more likely to repay on time. You also get rewarded with lower interest rates, higher credit limits, and better loan terms.

Improving your score even by 50–100 points can make a great difference in what offer you are getting from your lenders. It will be more affordable with approval.

How to Start Fixing Your Credit

In order to fix your credit score, first you have to understand what’s on your report. You can get a free copy of your credit report from all three major bureaus at AnnualCreditReport.com. Look for:

- Missed or late payments

- High credit card balances

- Collection accounts

- Errors or outdated negative items

Then you should dispute any incorrect information on your report and start working on making on-time payments consistently. This will surely help you to improve your score over time. You must work to pay down your credit card balances — keeping them under 30% of your credit limit, or even better, under 10%.

Let a Credit Repair Specialist Help

Rebuilding credit can feel exhausting — in case you don’t know where to start. At Great American Credit Repair, we have been helping clients since 2008. We help you to unlock better financial opportunities through credit repair. Our credit experts review your reports, dispute inaccurate items, and guide you with a smart plan tailored to your situation to raise your score and regain control.

We work with clients in Florida, New Jersey, California, Pennsylvania, and Virginia, and we’re ready to help you get the rates — and respect — your credit deserves.

Fix Your Credit, Save Your Money

You don’t have to keep overpaying because you have a low credit score. You can fix your credit, and get the opportunities like- lower rates, less stress, and more options. It’s one of the smartest financial moves you can make.Contact Great American Credit Repair today and let us help you unlock the better financial opportunities that you deserve.